AI & Artistry, the Resurgence of Hardware Startups, & Unicorns that are Really Rabbits

The uses of new technology for content creation vs. artistry are becoming more clear. Also, we will discuss hardware as a new startup moat and trends in the startup landscape.

Edition #37 of Implications.

This edition explores forecasts and implications around: (1) content creators being willing to trade control for speed – and artists definitively not, (2) a resurgence of hardware startups, (3) the perils of startups growing too fast and why some popular “unicorns” may prove to be rabbits, and (4) some surprises at the end, as always.

If you’re new, here’s the rundown on what to expect. This ~monthly analysis is written for founders + investors I work with, colleagues, and a select group of subscribers. I aim for quality, density, and provocation vs. frequency and trendiness. We don’t cover news; we explore the implications of what’s happening. My goal is to ignite discussion, socialize edges that may someday become the center, and help all of us connect dots.

If you missed the big annual analysis or more recent editions of Implications, check out recent analysis and archives here. A few recommendations based on reader engagement:

How will religion evolve in the era of AI? For the first time, we’ll get a response from something “all-knowing” about us. The transom with ASI (artificial super-intelligence) will work both ways. As AI works in ways that exceed our comprehension and becomes more mysterious, will its perspective carry weight? Will its advice become a self-fulfilling prophesy?

The final mile of leadership. Something happens in the final mile that truly tests leaders’ resolve and core values. When quick, key decisions can shift money around quickly, when the incentives of the leader and their team start to diverge, when the spotlight shifts, something changes. How a founder operates at such moments reveals so much. This is the mile of the journey by which leaders are truly measured.

Your time will become more valuable. I expect our culture to crave the exchange of undivided attention. Showing your hands during a zoom meeting, eye to eye contact at a table with your phone away, or voice memos and handwritten notes that demonstrate the time you gave to someone will have tremendous meaning. The sensation of giving someone your minutes will grow.

AI & Artistry

There are two types of people making stuff: content creators and artists.

Both are creative. But there is one distinct difference: Content creators are willing to trade control for speed. Artists are not.

Content creators are willing to trade control for speed. Creators are trying to get a good-enough cut, a performant-enough ad, or an engaging-enough YouTube or TikTok post. Creators know that modern brands must think and act in real-time. They know they need to move fast and they understand that most timeline and algorithmically programmed content is ephemeral. Whether it is the pizza shop needing a promotional video or the influencer making an opening sequence for their gaming show on YouTube or creating social and meme-driven content for our own social feeds, we all play in this new creator economy. The advent of prompt-driven, generative AI tools lowers the floor so that anyone can be a creator of some kind. As a result, the market has exploded. Between 80 and 90 percent of the creative market is now focused on the creator: Canva, Adobe Express, MidJourney, ChatGPT, Nano Banana, Gemini, and every other mainstream generative creation tool caters to creators. But creators are driven by the desire to accomplish something quickly. The content is often a means, not an end.

Artists are NOT willing to trade control for speed. Sure, artists do quick sketches and explorations, but these exercises are in service of exploring the full terrain of possibilities to find the absolute best direction. Artists have a distinct vision in their mind’s eye, and they will use whatever chisels, brushes, cameras, editing workflows, or other tools they need to achieve this vision with as little compromise as necessary. Artists require creative control and giving it up to some prompt-based generative tool is like the sculptor working without her hands. The artist’s creation, and achieving their exact vision, is the goal. Their tools must be in service of this goal. While a much smaller percentage of the creative market, artists make units of culture. Artists craft the meaning-infused stories that thrill and break us. While their work may not be fast or optimized for clicks, their stories teach us about ourselves and advance our understanding of the world.

Content creators and artists have different needs. Most tech headlines about AI have been about the impact on content creators and the insatiable desire and demand for content of all kinds. The majority of venture capital has been invested in tools for the “creator economy” – making ads, making endless amounts of YouTube and TikTok content, making social posts, etc – given its vast, if not infinite size. But lost in the shuffle is what artists need. People conflate what enables creators with what might replace artists. People see the “AI slop” capabilities of new generative models and then declare the “end of fine art” and “RIP Hollywood,” as if the founding of McDonalds would kill our desire for great cuisine. It is increasingly clear that artistry is here to stay. We will all continue to crave great stories and breakthrough art despite the surge of AI slop, much like we crave fine cuisine despite the abundance of fast food. What do artists need? They need ways to explore more surface area of possibility more quickly so they can find the right idea to pursue. They need modern workflows across different tools that offer more precision than ever with fewer obstacles and dependencies. They need new technology to give them more creative control, not less. And artists must feel the appetite to take more creative risk because when they do, our lives become better. There is a new breed of workflows emerging for artists that leverage new technology without compromising control and I’m excited as ever for the implications.

While I’m excited about the creator economy (and suspect this will be a growing job sector, as opposed to many others), I firmly believe that we will all crave more artistry in the age of AI. As content creators fill our feeds and brands flood the zone — all to grab our attention as cheaply and efficiently as possible, consumer preferences will shift towards more crafted and deeply human stories. As creating content becomes easier, the bar for what makes an extraordinary and unforgettable story will rise.

The Resurgence of Hardware Moats

There’s a decent argument that, as we approach AGI over the next five-10 years, the foundational models will be capable and incentivized to compete with the capabilities of every piece of software that was built on top of them. Doing so opens up new markets to justify their capex spend and capture margin at the application level across every vertical that has been transformed by AI. In a world where any interface and application can simply be summoned and tailor-made, it is not hard to imagine mass disruption across software as we know it.

One implication will be the growing popularity of vertically integrated products that include hardware in the mix. The specialized hardware/software combo is an ultra-resilient moat, so long as you don’t run out of capital before your product is done! The companies that thrive will look like Whoop or Oura, where the AI is tightly coupled with a wearable; Board, where the deployment of digital games happens on their own collaborative, physical game board; or Meter, where a vertically integrated networking solution for the enterprise includes both the industrial-grade hardware as well as the AI-powered tools for networking engineers to deploy applications and manage an enterprise network.

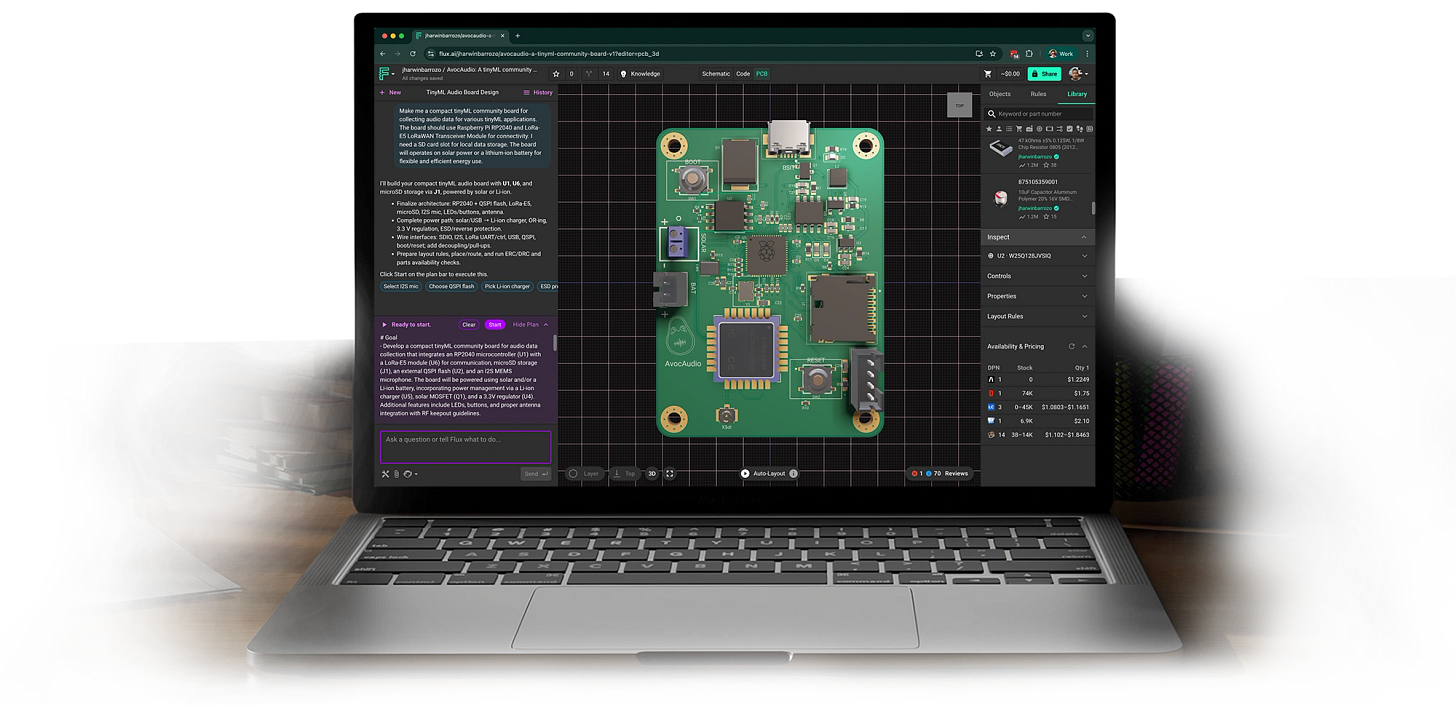

The complexities of hardware startups have historically been a turn-off for investors, given the specialized talent, complicated supply chain, and enormous costs required to successfully develop, launch, and scale. But a new breed of “picks and shovels” companies has emerged that streamlines traditional obstacles like chip design and manufacturing, prototype development, and supply chain management. For example, Flux offers a full browser-based way to use AI to design chips that are ready for fabrication, whether its a connected device, robot, smart home device, drone, and the list goes on. Other companies like Lumafield are outfitting hardware engineering teams with capabilities that were once only available to the world’s largest manufacturing companies. As teams of all sizes are able to rapidly develop and iterate hardware, I suspect we will see more vertically integrated hardware/software startups emerge that cannot so easily be replaced by an ever-powerful frontier AI model.

Are most unicorns actually rabbits?

Regular readers of Implications know about my obsession with running, but I have yet to run a marathon. If I ever do, I would pace myself to reach the finish line, as opposed to being one of the many “rabbits.” In marathon terminology, a rabbit is someone who starts a marathon running super-fast and, for a short while, is “winning” before quickly falling behind — unable to sustain the breakneck pace.

As the AI platform shift hits, we’re seeing a whole series of companies run fast out of the gate, in the form of record-setting growth rates and tens, if not hundreds, of millions in revenue within a couple years of their launch. But when you dig in, you learn that they’re not yet economically viable. And, in many cases, they are surprisingly interchangeable with competitors when it comes to their core utility. Rabbits are winning, but unsustainably. In some cases, they are selling their product for much less than the cost of the underlying API calls with LLMs. Anyone who sells a dollar for ten cents is going to have record-setting growth and a ton of revenue, but they won’t last.

Even before the AI era, as we look back at many of the so-called “unicorn” companies (those that raised money at a $1B+ valuation) over the last decade, we’re realizing that many of them were rabbits. Many of these companies leveraged venture capital to acquire customers without understanding (or willfully ignoring) lifetime value or unit economics. Some of these companies told a story in the press that misrepresented the true nature of their traction. Perhaps we should have known better when hundreds of unicorns were minted. If unicorns are everywhere you look, are they still unicorns?

How does a high-growth, ambitious company avoid becoming a rabbit? Seek a valuation that makes your newest employees feel rewarded over the next two years (as opposed to seeing their equity value stay stagnant or lose value in a down round). Challenge yourself to improve customer acquisition costs in tandem with growth rates. And focus on customer impact, especially at this moment in the platform shift in which products hit huge growth numbers (everyone wants to try everything!) but struggle with sustained use and retention. Set goals and celebrate milestones that are more related to customer impact than wild growth and top-line revenue without any path to profit.

What makes a true, rare, special, and one-of-a-kind unicorn? In my book, if a company achieves $50M+ in revenue with a sustained, if not growing, 40+ percent growth rate and line of sight to achieving profitability, if not already cashflow-positive, it is remarkable. Otherwise, if a company is making tons of revenue and raises at a $1B+ valuation without such characteristics, it is liable to be a rabbit.

Portfolio highlights & opportunities

A few updates on companies i’ve supported as an angel:

Mem0 launched their universal, self‑improving memory layer for LLM applications, powering personalized AI experiences that cut costs and enhance user delight. The Mem0 team has been hustling for quite some time to help companies remember their customers in the age of AI — rather than have this knowledge live with their foundational model providers. The team is hiring engineers and dev relations positions.

Lightfield had their public launch of “an AI-native CRM that remembers everything, then acts on it. Lightfield automatically captures and organizes every customer conversation across email, meetings, and notes, creating your team’s collective customer memory. Lightfield helps founders learn from every interaction, which has a ton of unexpected implications when you start to search or pose queries.

A product called “Shelf” from Koodos has been growing on all cylinders as a way to automatically show the music, shows, books, and other things you’ve enjoyed this week to friends. I highly recommend playing with Shelf. Under the hood, Koodos is building a graph of user preferences that can help us discover things we want to do, people we want to meet, and more.

Knock, a company that makes infrastructure for sending product and customer messages, released Guides, which has had overwhelmingly positive customer response. Guides lets you use your own components (rather than slow external JavaScript libraries) to power in-app messages that drive activation and upsells. If you’re building an app and seek world-class notifications and messaging for your customers, I highly suggest checking out Knock.

Scribe recently announced their Series C round of financing at a $1.3B valuation, which is notable given how under-the-radar this team has been since their initial launch. They started by building a standard for documenting how work gets done: self-writing documentation that captures invisible know-how and scales it to colleagues, customers, and clients. They have since launched AI capabilities that are getting customers excited. The team is hiring for a Director of Talent, production management, and more.

Ideas, missives & mentions

Finally, here’s a set of ideas and worthwhile mentions (and stuff I want to keep out of web-scraper reach) intended for those I work with (free for founders in my portfolio, and colleagues…ping me!) and a smaller group of subscribers. We’ll cover a few things that caught my eye and have stayed on my mind as an investor, technologist, and product leader (including a perspective on heritage as a moat for brands, the three layers of a modern story, learnings from Coca-Cola on the perils of using AI without creative control, and a few data provocations). Subscriptions go toward organizations I support including COOP Careers and the Museum of Modern Art. Thanks again for following along, and to those who have reached out with ideas and feedback.